Closing the deal

An affiliate of GLPI will pay a negotiated annual rent of $20 million to Blue Owl Capital. GLPI will own nearly all of the real estate and improvements included in the deal, totaling a net investment of nearly $1.2 billion.

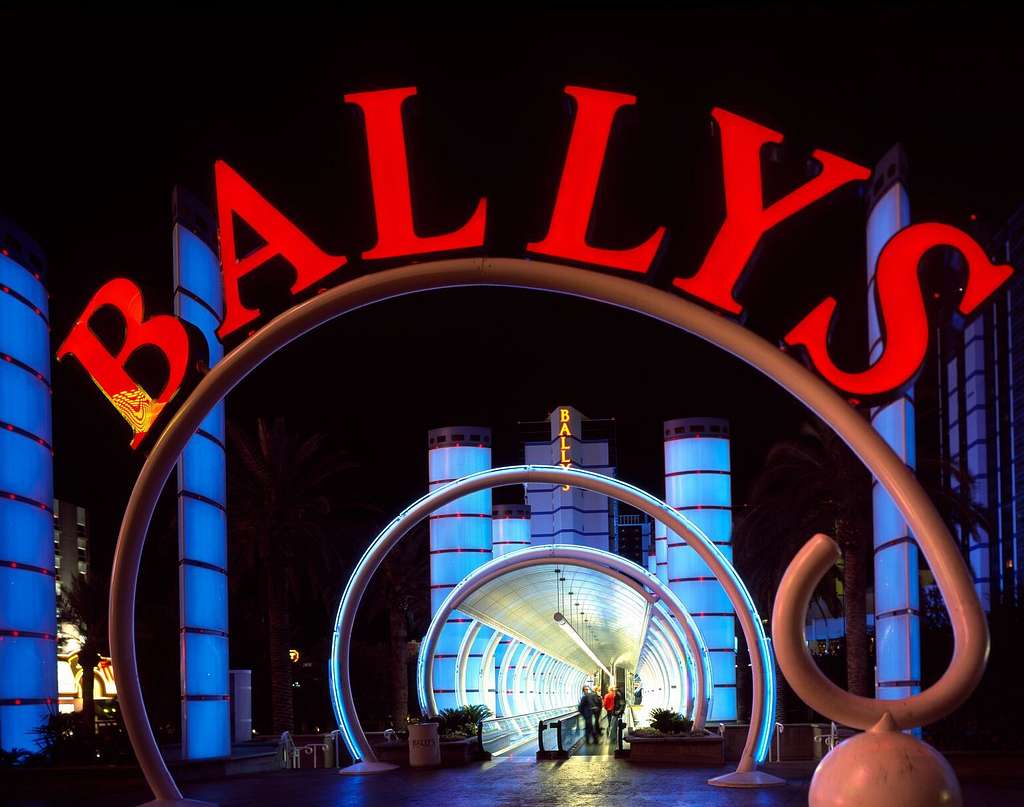

“The completion of the Chicago land purchase is a significant milestone toward the development of Bally’s Chicago, which promises to be a must-visit destination casino resort property in the heart of Chicago,” said GLPI Chairman and CEO Peter Carlino.

“Our transactions with Bally’s related to Chicago and our real estate acquisitions at Bally’s Kansas City Casino and Bally’s Shreveport Casino & Hotel will be accretive to our financial results, resulting in an 8.3 per cent blended initial cash yield and conservative rent coverage.”

The rent coverage mentioned is expected to fall between 2-2.4x the current amount.

“We are pleased to be working with the Bally’s team, the host community and various stakeholders in Chicago to deliver a world-class entertainment [center] in the nation’s third largest metropolitan area.”

Waiting for the final project

While the full-fledged Bally’s Chicago casino won’t launch for roughly another two years, its temporary facility at the Medinah Temple has been a major success.

The provision property earlier this week celebrated one year of operation, during which it welcomed 1.3 million visitors and generated more than $114 million in gross gaming receipts. That revenue led to $12.9 million in local tax payments, per the Illinois Gaming Board.

Chicago officials believe that the full-scale Bally’s property—which will include a 34-story and 500-room hotel, a 3,000-seat theater, a two-acre park, 3,300 slot machines, 173 table games, six restaurants, VIP areas, and a food hall—will result in $35 million in annual tax funding.

Illinois casinos’ tax payments are decided by a scaled rate according to their adjusted gaming revenue. Non-table games are taxed 15-50 percent, while table games are taxed 15-20 percent.

Illinois during the summer introduced a tax hike for its sports betting operators as a way to generate more tax revenue. The state significantly upgraded the fixed rate of 15 percent to a sliding scale ranging from 20-40 percent based on operators’ revenues.