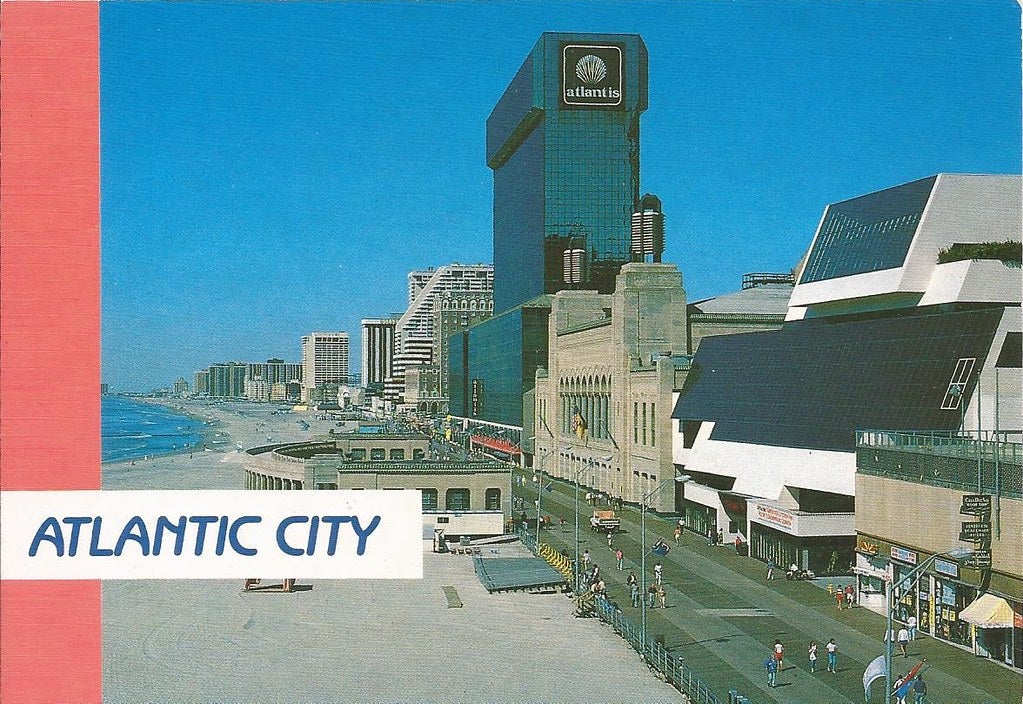

Embarking on a transformative journey

Bally’s unlocked $940 million in funding after it announced a strategic partnership with Gaming and Leisure Properties in July.

The agreement led to the creation of an improved build plan for a 30-acre casino and hotel complex.

The project will lead to the development of a 34-story and 500-room hotel with a 3,000-seat theater and a two-acre public park. The casino will house 3,300 slot machine terminals, 173 table games, VIP areas, six restaurants, cafes, and a food hall.

Developers will also erect a state-of-the-art hotel tower on the southern end of the complex near Ohio Street. The tower will feature a pool, a spa, a fitness center, and a rooftop restaurant for both hotel guests and visitors.

Chicago Mayor Brandon Johnson previously said that it was “Still to be determined” if the casino plans would materialize. Bally’s rebuffed his comments in mid-June when a spokesperson said the company’s plans were on track and progressing as intended.

Bally’s was selected for a casino license over bidders affiliated with BetRivers and Hard Rock in part because the company offered to pay $40 million up front. The casino is expected to become operational in September 2026.

Impact of a new Chicago casino

While Chicagoans wait for the grand opening of the transformative property, Bally’s already has a solution for the present.

The casino company opened a temporary facility within the Medinah Temple in River North in September 2023. The casino reported record revenues and visitations in May and recently welcomed its millionth visitor, suggesting that the full-fledged property will have the interest and support of locals.

Bally’s temporary property also reported $62.8 in adjusted gross receipts and generated $6.8 million in taxes during the first half of the year, which are promising signs. Revenue decreased 11 percent month-over-month in June, though visitation still increased one percent.

Illinois casinos are taxed on a scaled rate according to their adjusted gaming revenue. All non-table games can be taxed anywhere from 15 percent to 50 percent while table games can be taxed 15-20 percent depending on their AGR totals.

Illinois also introduced a tax hike for sports betting operators earlier in the summer. Since sports betting went live in the state in June 2021, operators paid a fixed rate of 15 percent. However, the new sliding system mandates they pay a minimum of 20 percent and a maximum of 40 percent.