Macau’s Gaming Sector Performance

The appealing nature of the Macau gaming sector’s valuations has some investors considering taking profits. However, experts recommend a confident approach to gaming equity investments. CBRE noted that Macau gaming stocks are currently trading at an average one-year forward EV/EBITDA (enterprise value of earnings before interest, taxation, depreciation, and amortization) multiple of 9.2x, lower than the 2019 average of 11.2x.

“Even after last week’s rally, the average one-year forward EV/EBITDA multiple for Macau gaming equities is 9.2 times,” stated analysts Max Marsh and John DeCree.

Impacts of China’s Economic Adjustments

China’s economic stimulus package indicates a shift from previous efforts underscored by aggressive monetary policy changes like Reserve Requirement Ratio (RRR) and short-term benchmark interest rates. The stimulus announcement is the first of its kind since 2015, characterizing the country’s appetite for credit flow and economic activity.

The package features economic drivers like cutting residential mortgage rates and removing purchase restrictions to stabilize home prices. Bolstering the real estate sector is crucial since it accounts for 70% of China’s household wealth. It will also inject liquidity into the banking system.

Morgan Stanley Upgrade

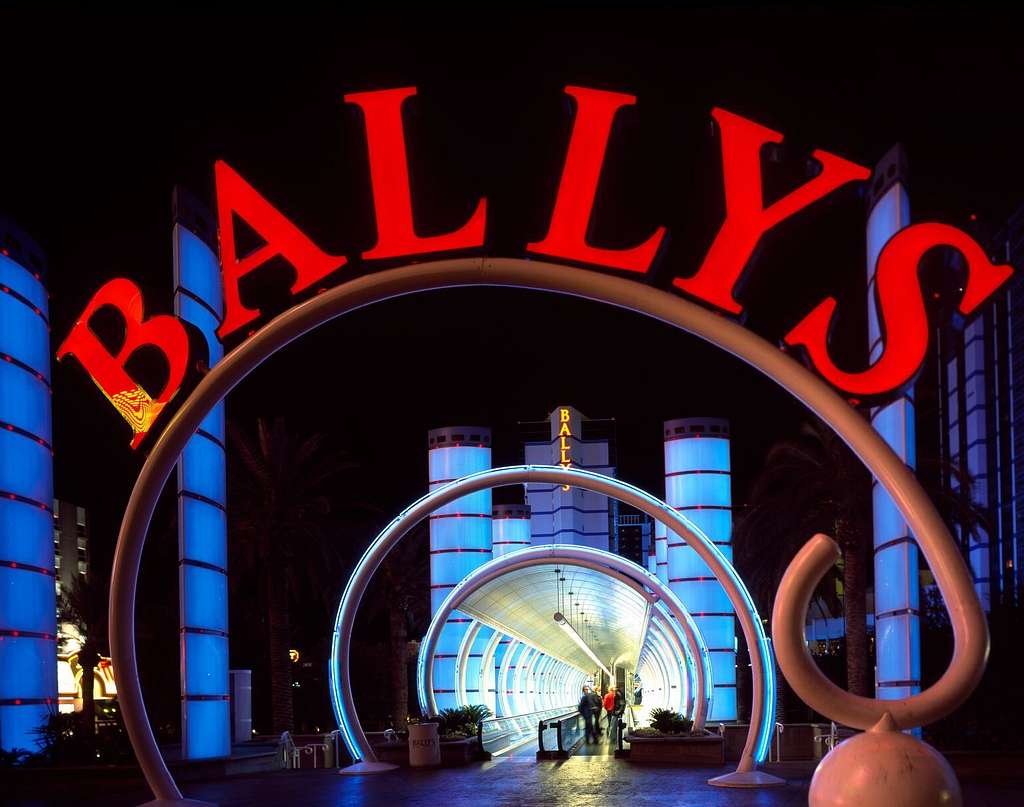

All casino operators stand to benefit from the package, but Wynn Resorts and Las Vegas Sands are the most favored. Wynn is a behemoth in the global gaming landscape, and the economic boost reassures long-term investors. The conglomerate’s shares also received an extra boost from Morgan Stanley, resulting in upgraded stock. The investment bank raised its rating from “equal-weight” to “overweight” and elevated the price target from $7 to $104.

On the other hand, Las Vegas Sands boasts the largest hotel and retail presence in Macau. This quality places it in the prime position for favorable demand and visitor numbers. The company anticipates better comparisons in 2025 as it closes on significant upgrades at its Londoner property.

.jpeg)